GST Reforms Power India’s Green Transition: Affordable Sustainability Aligned with Net Zero 2070

Manoj Singh Chandel / KP Singh

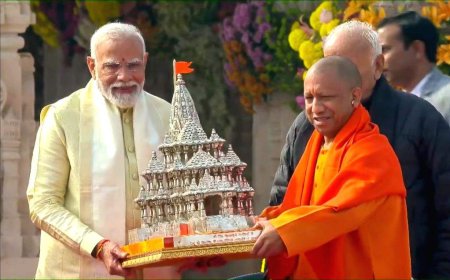

Under the leadership of Prime Minister Narendra Modi, the reforms aim to make sustainability affordable and accessible to both industries and consumers, while encouraging innovation, domestic manufacturing, and green entrepreneurship. They also reinforce India’s adherence to its commitments under the Paris Agreement by mainstreaming eco-friendly alternatives across sectors.

At the 26th Conference of Parties (COP26) to the UNFCCC in November 2021, India pledged to achieve Net Zero by 2070. The approach is built upon four key pillars — India’s minimal historical emissions, its growing energy needs, the pursuit of low-carbon pathways, and enhanced climate resilience.

Renewable Energy Gets a Tax Boost

In a major relief for the renewable energy sector, GST on solar and wind devices — including solar cookers, biogas plants, solar power generators, windmills, waste-to-energy devices, and photovoltaic cells — has been slashed from 12% to 5%.

The move is expected to significantly lower capital costs for solar panels, PV cells, wind turbines, and other green infrastructure components. This will directly reduce the tariff burden for consumers while boosting the competitiveness of India’s domestic manufacturing under the ₹24,000 crore Production Linked Incentive (PLI) Scheme for High-Efficiency Solar PV Modules.

“Lower taxes mean faster project deployment and greater affordability,” said a senior official from the Ministry of New and Renewable Energy. “It will help India build a resilient solar ecosystem and reduce dependency on imports.”

As a result, solar pumps will become more affordable for farmers, reducing irrigation costs while promoting clean energy use in agriculture.

India’s installed solar energy capacity has soared from 2.82 GW in 2014 to 119.54 GW as of July 2025, marking a fortyfold increase in a decade. Simultaneously, the emission intensity of India’s GDP has fallen by 36% between 2005 and 2020, demonstrating a clear decoupling of economic growth from carbon emissions.

Strengthening Waste Management & Pollution Control

To promote cleaner industrial ecosystems, GST on services provided by Common Effluent Treatment Plants (CETPs) has been cut from 12% to 5%. This reform will make industrial waste treatment more cost-effective, motivating industries to opt for centralized waste management facilities that ensure minimal environmental pollution.

According to the Ministry of Environment, as of August 2025, India has 222 CETPs, including 53 zero-liquid-discharge plants spread across key industrial states. The GST cut is also expected to generate new green jobs in waste segregation, treatment operations, and plant maintenance, contributing to the circular economy.

Municipal bodies are expected to benefit as well, as lower taxes make it easier to integrate renewable technologies into waste processing and energy recovery projects.

Encouraging Plastic Alternatives

In a step toward reducing plastic waste, the government has reduced GST on biodegradable bags from 18% to 5%. This measure will make eco-friendly packaging options more affordable for both producers and consumers, helping phase out single-use plastics in accordance with the Plastic Waste Management Rules, 2022.

The tax cut is also a major boon for small and medium enterprises producing biodegradable materials such as starch-based and compostable polymers. The demand for these alternatives is expected to rise sharply, spurring innovation and investment in the biodegradable materials sector.

“Biodegradable bag makers are now able to scale faster,” said a startup founder from Bengaluru. “Lower GST means we can compete with plastic producers while protecting the environment.”

Green Mobility for Cleaner Air

In a decisive move toward sustainable transport, GST on buses with over 10 seats has been reduced from 28% to 18%, making public and shared transport more affordable. This reform will encourage corporate fleets, schools, and state transport undertakings to expand their vehicle base, leading to modernization and reduced emissions.

Likewise, GST on commercial goods vehicles, including trucks and delivery vans, has been reduced from 28% to 18%. Since trucks handle over 65% of India’s freight, this measure is expected to lower logistics costs, promote fleet renewal, and curb vehicular pollution by phasing out older, less efficient vehicles.

“These reforms strike a balance between economic growth and environmental responsibility,” said a senior official from the Ministry of Road Transport. “Cleaner fleets mean cleaner cities and a healthier workforce.”

Driving Toward a Sustainable Future

The GST rationalisation marks a major policy shift towards affordable sustainability, reinforcing India’s global leadership in green transformation. By lowering taxes on renewable energy technologies, waste treatment systems, biodegradable materials, and sustainable transport, the government has created a strong foundation for accelerating climate action.

The move is expected to catalyse green entrepreneurship, boost domestic production, and make sustainable lifestyles more accessible to India’s 1.4 billion citizens.

As India charts its course toward Net Zero 2070, the message is clear — sustainability and affordability are no longer at odds. Through smart taxation, inclusive growth, and technology-driven solutions, the nation is building an economy that’s not only cleaner and greener but also future-ready.

What's Your Reaction?